Nettlecombe Oil Company, Inc.

Houston, Texas, United States

Nettlecombe Oil Company, Inc.

!

Texas Oil And Gas Company.

About Nettlecombe Oil Company, Inc.

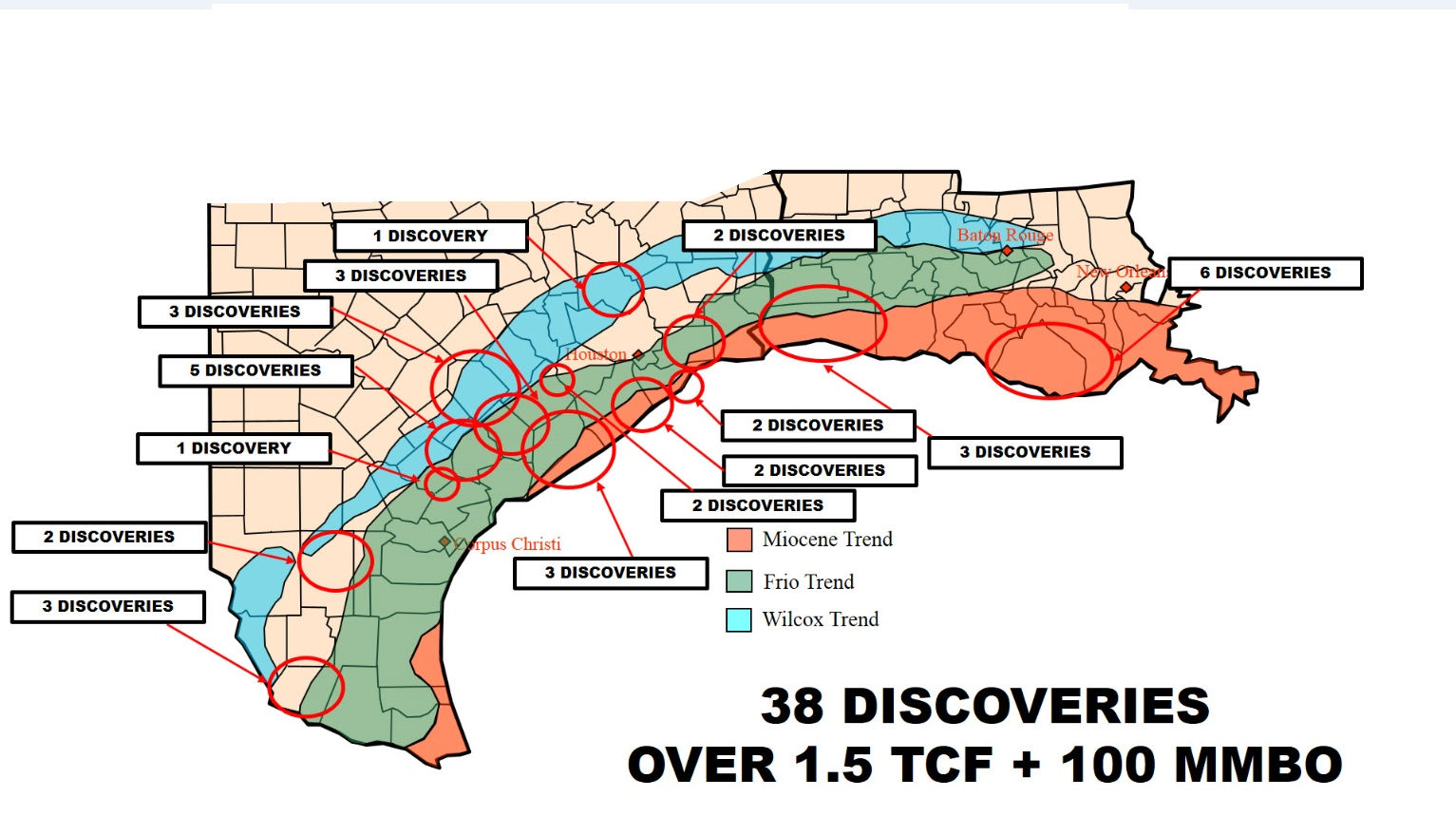

Nettlecombe is an oil & gas exploration firm that utilizes advanced geophysical technologies to identify oil and natural gas accumulations, primarily along the Texas coastal plain and in South Texas. Nettlecombe began exploring for oil and natural gas in the Miocene, Frio, and Yegua sands in Texas because we felt that the seismic frequencies and amplitudes in the shallow and intermediate-depth sand sections were more valid, dependable and less risky than looking for deep structural plays.

Nettlecombe’s business model is as a prospect generator. Using 3-D seismic as our primary tool, we find what we believe to be likely oil and/or natural gas accumulations that meets our various criteria. We then lease the acreage so that it will be ready to drill once the prospect sale has been fully subscribed. We sell promoted Working Interests (generally on a cash plus “Back-in After Payout” basis) with the Operator taking a significant Working Interest. Once the prospect is sold, it is turned over to the Operator to actually drill and produce the well.

Whether you’re looking for a joint venture gas well or oil well exploration opportunity, Nettlecombe has the experience to assist you with your exploration investment needs.

Description of Services

Investors

Through direct participation programs in oil and gas, investors actually own a portion of the well and receive a share of the cash flow generated via monthly disbursements. In addition to the income potential, oil and gas investments offer substantial tax benefits, which the U.S. government has designed to encourage domestic drilling. Since the Tax Reform Act of 1986, direct participation programs in oil and gas are one of the few remaining investments that allow investors to shelter income, making it one of the most tax advantaged investments today. Investors may be able to deduct as much as 65 to 100 percent of their investment within the first year, whether the well is successful or not, and 15 percent of your income is tax-free

What we do

Other Services:

- Consulting

The research required for prospect generation is normally pursued in conjunction with subsurface geology and elements of petroleum engineering. In this respect, Nettlecombe has excellent energy industry associations that establish the impressive scope of their business approach: i) geophysics & geology; ii) petroleum engineering; iii) land & legal and: iv) Prospect & feasibility studies publishing.

In addition to log and seismic modeling plus direct drilling experience, Nettlecombe has grown to understand the importance of good petroleum engineering and vigilance in production operations as adjuncts to effective earth science. Through careful selection of its industry partners, Nettlecombe thus intends to continue minimizing the risk in drilling prospects.

Nettlecombe began exploring for natural gas in the Miocene, Frio, and Yegua sands in Texas because we felt that the seismic frequencies and amplitudes in the shallow and intermediate-depth sand sections were more valid, dependable and less risky than looking for deep structural plays.

- Production Exploitition of Existing Reservoirs

One of the safest and more profitable means to extract Oil/Gas is to go in close to existing wells that have proven production history. Over the past few years the Oil/Gas markets have seen a great deal flux in value dollars both domestically and international. By staying with our comfort zone ( Miocene, Frio, Yegua and Catahoula Sands) we have found a great deal of success in PUD (Proven Un-Developed) reserves.

- Joint Ventures

When Nettlecombe first began, it utilized friends and small investors to participate in the drilling of wells. This was initially satisfactory until unforeseen contingencies would occur, making it obvious that the prospects were under-financed. Nettlecombe has since decided to restructure its mode of operations, commencing the generation of prospects from its large seismic data base and, utilizing “Lease Bank” funding partners to obtain leasehold and to help pay for the overhead and expenses for generating the prospects. Nettlecombe presently takes some cash and an overriding royalty interest upon the sale of its prospects to an outside party.

Under the relationship envisioned, Nettlecombe would commit to a joint venture with the new partner in exchange for a working capital commitment and the right to participate in the funding of drilling prospects and other selected oil & gas projects such as “engineering plays” in which the company is often invited to participate.