NOG

Minnetonka, Minnesota, United States

NOG

!

The Leading Non-Operated Franchise.

About NOG

NOG is the largest, publicly traded, non-operated, upstream energy asset owner in the United States that engages in the acquisition, exploration, development and production of oil and natural gas properties, primarily in the Williston, Uinta, Permian, and Appalachian basins.

Our strategy of acquiring minority interests in core assets across multiple basins operated by leading operators provides NOG with optionality unavailable to traditional E&P companies.

The Company’s size and intimate knowledge of the U.S. Lower 48 basins give it an advantage in making quick decisions, which attracts vigorous deal flow.

Description of Services

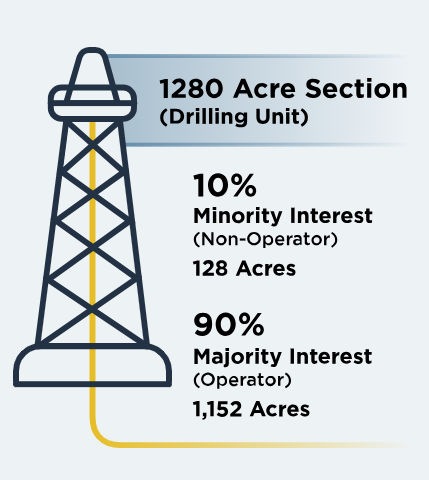

Non-Operated Pooled Unit Example

-

NOG acquires non-operated positions in high-quality acreage with a focus on timing of development

That provide for high internal rates of return on capital.

-

We partner with leading E&P operators with a successful track record

Ensuring reliable performance and diversification of operational risk.

-

Our engineers evaluate each drilling proposal in the unit as the Operator develops it

Our minority interest means we own a percentage of the full unit requiring us to be diligent in monitoring the operator's drilling and capex plans.

-

We can provide or withhold consent on our pro rata share of drilling capital on a well by well basis

NOG has the right to consent to its pro rata ownership capital commitment, giving it flexibility on incremental capital deployment on a well by well basis for the full drilling unit's development plan.

Differentiated Upstream Platform

Our business strategy is to capture and participate in only the highest-return opportunities across premier U.S. oil and gas basins. We leverage our industry relationships, expertise, and capital allocation flexibility to create value for our shareholders by growing reserves, production, and cash flow on a cost-efficient, sustainable basis.

The "Go To" Buyer of Non-Operated Positions

Our established business model has successfully grown production and proved reserves since inception. NOG continues to evaluate and expand its acreage footprint and multi-year drilling inventory through selective, bolt-on acquisitions in areas identified by the Company as being prospective for generating high rates of return throughout commodity cycles. Leading operators recognize NOG as the "go to" buyer of non-operated positions.

NOG is focused on what it means to be accountable to the shareholder. Our unique model provides capital flexibility, discipline, and optionality allowing NOG to execute on an optimal strategy that grows total shareholder value over time.

What we do

NOG is the largest, publicly traded, non-operated, upstream energy asset owner in the United States that engages in the acquisition, exploration, development and production of oil and natural gas properties, primarily in the Williston, Uinta, Permian and Appalachian basins.

Our Results are Driven by Data

NOG is a data-driven enterprise. Analysis of proprietary data and ability to precisely forecast prior well investments informs our capital allocation process. Our data lake includes performance and operational data across 100 operators, over 10,000 wells, three basins and two commodities. Our seasoned engineering team, many of whom are alumni of industry peers, leads our technical analysis.

We Do Deals

Since 2018, NOG has completed nearly $5.0 billion of bolt-on strategic acquisitions and purchased hundreds of small to large-scale Ground-Game interests in wells and drill-cos. We are a trusted provider of capital to the E&P Industry. No deal is too big or too small.

Life at NOG

High Quality, Low Break-even, Price Resilient.

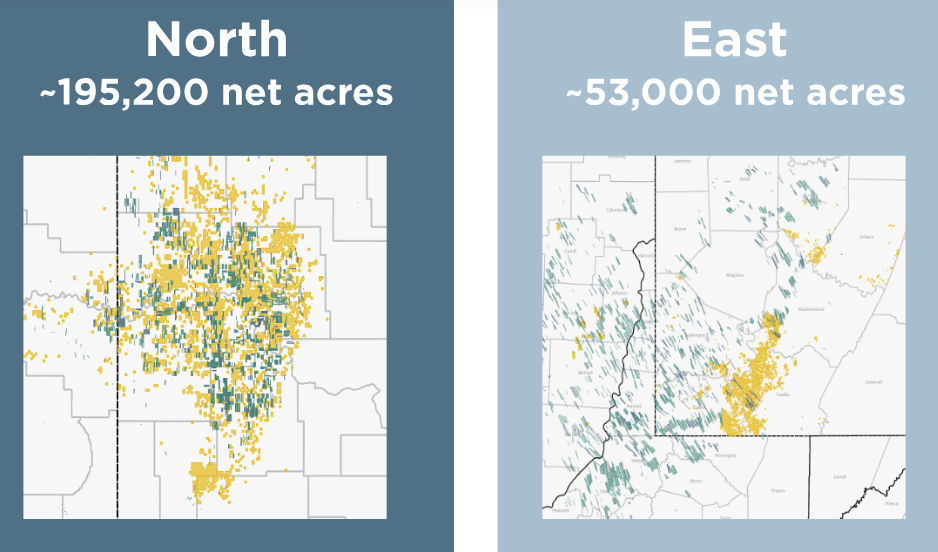

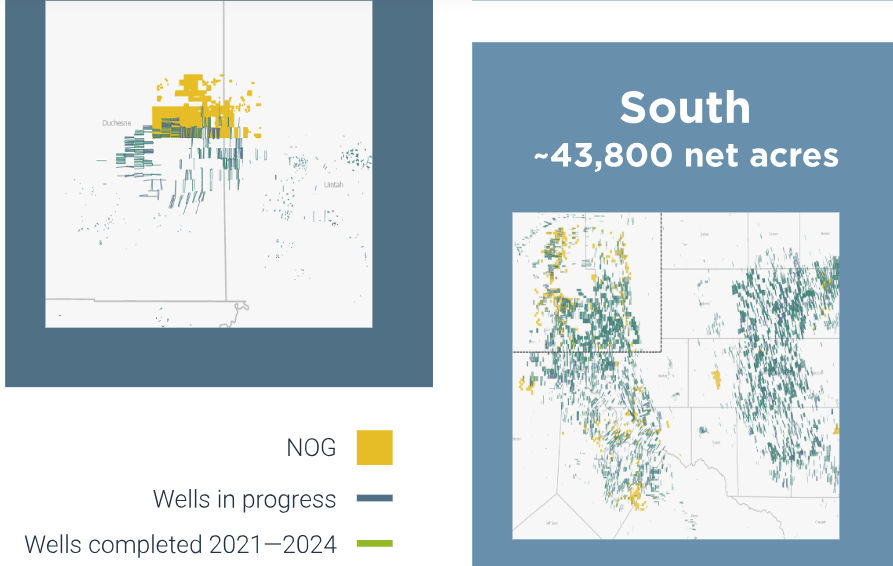

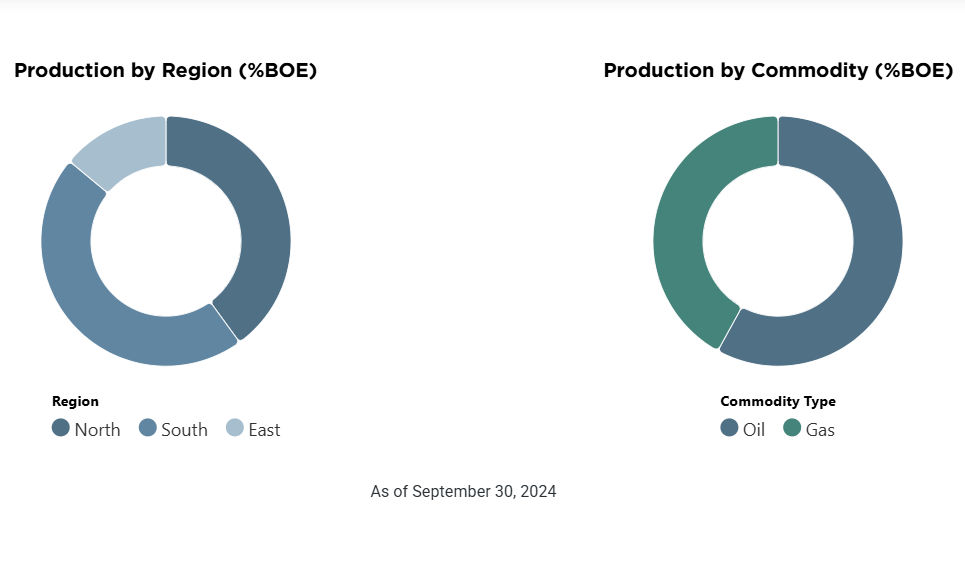

NOG's ~300,000-acre portfolio is distributed across the Williston, Uinta, Permian and Appalachia Basins.

Our Portfolio

NOG's portfolio comprises ~300,000 acres of high-quality, low-breakeven lands with over 10,000 wells. Diversified by basin and across commodity type, our wells are operated by over 100 public and private operators.