Verdun Oil Company

Houston, Texas, United States

Verdun Oil Company

!

Verdun Oil Company is a privately held oil & gas company based in Houston, Texas focused on acquiring, developing, and producing assets in South Texas.

About Verdun Oil Company

Verdun Oil Company is a privately held oil & gas company based in Houston, Texas focused on acquiring, developing, and producing assets in the Eagle Ford shale and Austin Chalk trends in South Texas. Verdun was formed in 2015 with equity commitments from management and EnCap Investments.

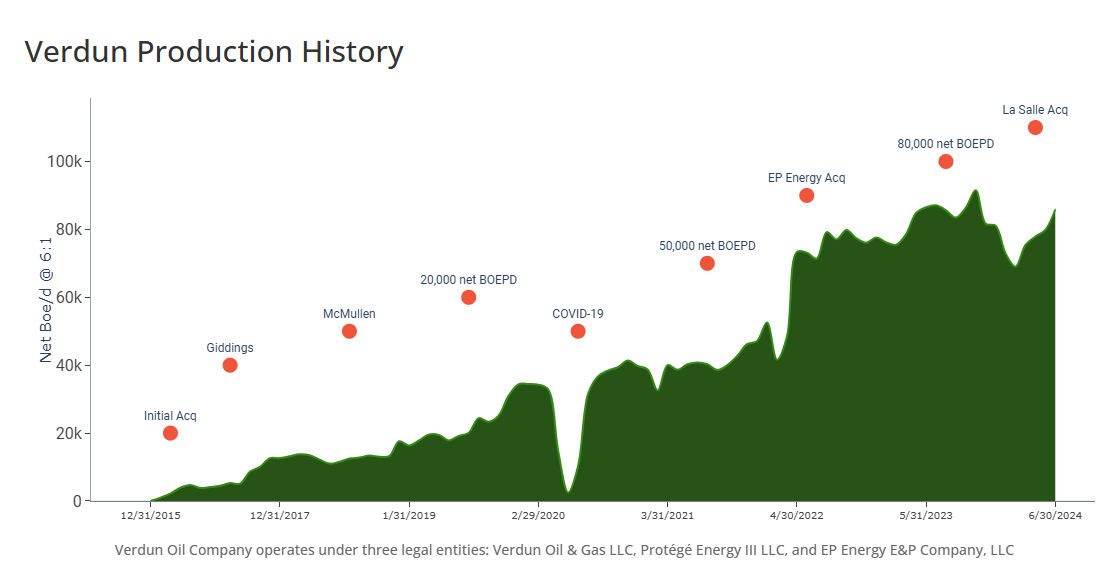

The Company has grown through a series of acquisitions and a successful continuous development program to be one of the largest privately held companies operating in South Texas in terms of asset size and hydrocarbon production.

December 2015

Verdun Oil Company was founded in December 2015 to acquire and operate historically undercapitalized oil & gas assets in cost-advantaged plays with proximity to end markets and energy-friendly regulatory environments

2016

Acquired Eagle Ford producing assets consisting of over 11,000 net acres and 2,000 BOEPD in Live Oak, Dimmit & La Salle Counties

Completed first 2 Eagle Ford wells at ~2,400 BOEPD each

2017

Acquired entry position in the Giddings field with Austin Chalk leases held-by-production (“HBP”)

Acquired Eagle Ford producing assets consisting of 2,700 net acres and 1,250 net BOEPD in Live Oak County

Acquired Eagle Ford producing assets consisting of 1,900 net acres and 600 net BOEPD in Gonzales & DeWitt Counties

2018

Acquired 2,210 net acres (81% NRI) of non-producing leasehold located in the oil window of McMullen County

Acquired Eagle Ford producing assets consisting of 5,460 net acres and 850 net BOEPD located in Karnes and Live Oak Counties

Completed the first full liner isolation refrac ever performed in the Eagle Ford (April 2018)

2019

Eclipsed 20,000 net BOEPD milestone in early 2019

Acquire Eagle Ford producing assets consisting of 11,200 net acres and 700 net BOEPD in La Salle & McMullen Counties

Launched distribution to equity program financed by company free cash flow

2020

Implemented COVID-19, price-driven production shut-in; no new-well development through the remainder of the year

Acquired Protégé Energy III’s Eagle Ford assets located in Dimmitt and Atascosa Counties with 12,000 net BOEPD of production across 24,600 net acres

2021-2022

Eclipsed 50,000 net BOEPD milestone in early 2021

Acquired Eagle Ford property consisting of 4,853 net acres in McMullen and Live Oak Counties

Acquired EP Energy, with assets located primarily in LaSalle County, TX producing 22,000 BOEPD from over 950 operated wells across 110,000 net acres

Formed compression business unit to acquire and manage over 87,000 HP of compression and servicing >50% of Verdun’s total utilization

Acquired additional Eagle Ford assets in Dimmit, La Salle & McMullen Counties

Completed 50th refrac in December 2022

2023-Present

Curtailed dry gas production in response to NYMEX Henry Hub price weakness

Eclipsed 80,000 net BOEPD milestone in 1Q23

Completed 75th refrac in November 2023

Acquired Eagle Ford properties in La Salle County including over 34,000 net acres, 193 producing wells, and 8,500 BOEPD

Description of Services

Vision:

To be the standard against which other E&P companies are measured in terms of operational efficiency, creativity, decision making, corporate responsibility, and profitability.

Mission:

Verdun’s Mission is to bring together a top-tier group of motivated employees focused on identifying, acquiring, and optimizing the recovery of oil and gas reserves at an industry-best cost basis while maximizing the benefits to our employees, landowners, and the communities where we operate.

Business Philosophy & Values

Create Alignment at All Levels

A rising tide lifts all boats: company, employee, landowner, vendor, and community.

Optimal Efficiency; Move Fast and in the Right Direction

Best-in-class performance requires both urgency and good decision making.

Work Hard & Have Fun

A successful, sustainable business cannot survive the test of time without both.

There is always a better way

Continuous improvement is not only possible, but necessary.

What we do

Operations

Verdun Oil Company is strategically focused on the Eagle Ford Play which has proven to be one of the most prolific and profitable plays in the world.

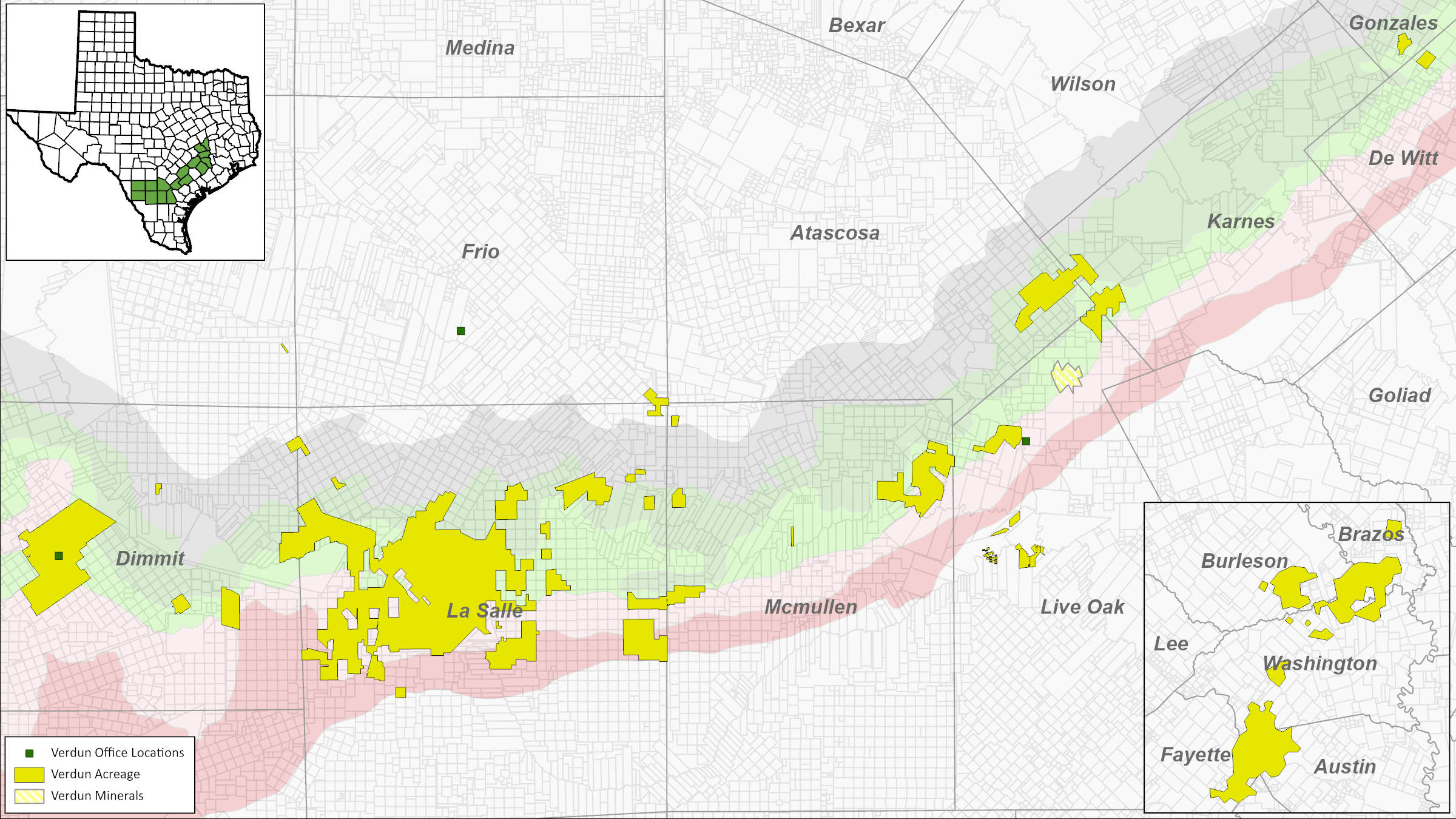

Verdun Oil Company owns and operates leasehold spanning from Dimmit to DeWitt County, TX, primarily focused on the oil and condensate windows of the Eagle Ford trend and additional Austin Chalk acres in the dry gas window of the Giddings Field. The Company currently holds an expansive acreage position of approximately 282,000 net leasehold acres (97% operated), with over 227,000 net acres in the Eagle Ford trend and 55,000 net acres in the Giddings Field. We also own royalty interest in approximately 15,300 net royalty acres, 93% operated by Verdun.

Through numerous acquisitions and a successful development program, Verdun has grown net production to approximately 90 MBOED (60% oil, 80% liquids | 94% operated) since inception, while keeping over 10 MBOED of dry gas production curtailed due to market conditions. Unconstrained production exceeds 100 net MBOED.

With over 1,100 Eagle Ford and Austin Chalk undrilled locations remaining, Verdun has more than 15 years of high-value drilling inventory and proven redevelopment opportunities to supplement greenfield locations.

Verdun is a leader in recompletion of existing wellbores having launched its refrac program in early 2018 with the Eagle Ford’s first full liner isolation refrac and executed approximately 100 recompletions to-date. Our inventory of recompletion opportunities adds years of incremental, highly economic development.

Ample takeaway and proximity to the Gulf Coast provides optionality and access to premium markets.

Verdun has extensive, company-owned infrastructure in place reducing overall cost structure and allowing for full-field development with minimal future capital outlay. Infrastructure includes over 87,000 HP of company-owned compression (>50% of total utilized), 2 saltwater disposal wells, over 80 central production facilities, over 500 miles of gathering and sales lines, 78 frac ponds, more than 50 water supply wells, and real-time surveillance on ~98% of assets. All this in combination with efficient, cost-conscious operations results in gross LOE per BOE of ~$4.00 and Midstream Expense of ~$2.00 per BOE. Altogether the Company realizes gross OPEX per BOE of ~$6.00 and net operating cash flow margins of over 80%.

Verdun’s Giddings Austin Chalk wells deliver initial production rates of over 20 MMCFD (100% natural gas) and high flowing pressures >7,000 PSI allowing for long flat production periods and high ultimate resource delivery. The Company curtailed production at Giddings beginning in 2023 due to market conditions and is opportunistically cycling wells during periods of high natural gas prices.

Life at Verdun Oil Company

Corporate Responsiblity

Environmental

We will protect the environment and promote environmental stewardship in the areas where we operate, and we will never compromise our safety procedures and measures.

Focus on maintaining the highest standard of operational safety in the field.

- Verdun has devoted ESG personnel on staff to ensure best practices in safety and environmental stewardship.

- Employ company-wide HSER Tracking and Observations systems for incident reporting and communicating/ensuring proper safety protocols & best practices

- Remuneration for company employees incorporates HSER performance.

- Require rigorous monthly EHS training for all field personnel.

- Conduct random drug testing of all personnel on location.

Devote substantial resources to maximizing operational efficiency, while at the same time eliminating health and safety risks to our stakeholders and the environmental impact caused by spills and releases.

- Multiple steps taken to reduce carbon footprint, including but not limited to installing Vapor Recovery Units (“VRUs”) on 99% of production and utilizing field gas instead of diesel to fuel hydraulic frac pumps.

- Over 80% of produced oil and water transported on pipe to minimize the number of trucks on the road.

- Recycle produced wastewater for use in ongoing completion operations.

- Flare less than 1% of total natural gas production volume.

- Proactive implementation and retrofit of instrument air to minimize IRA tax burden.

Corporate Governance

We ensure that our business practices comply with all applicable laws and regulations

Social

We treat all employees, stakeholders, and others who are affected by our activities fairly and without prejudice to gender, race, ethnic or national origin, socioeconomic status, age, religion, or disability